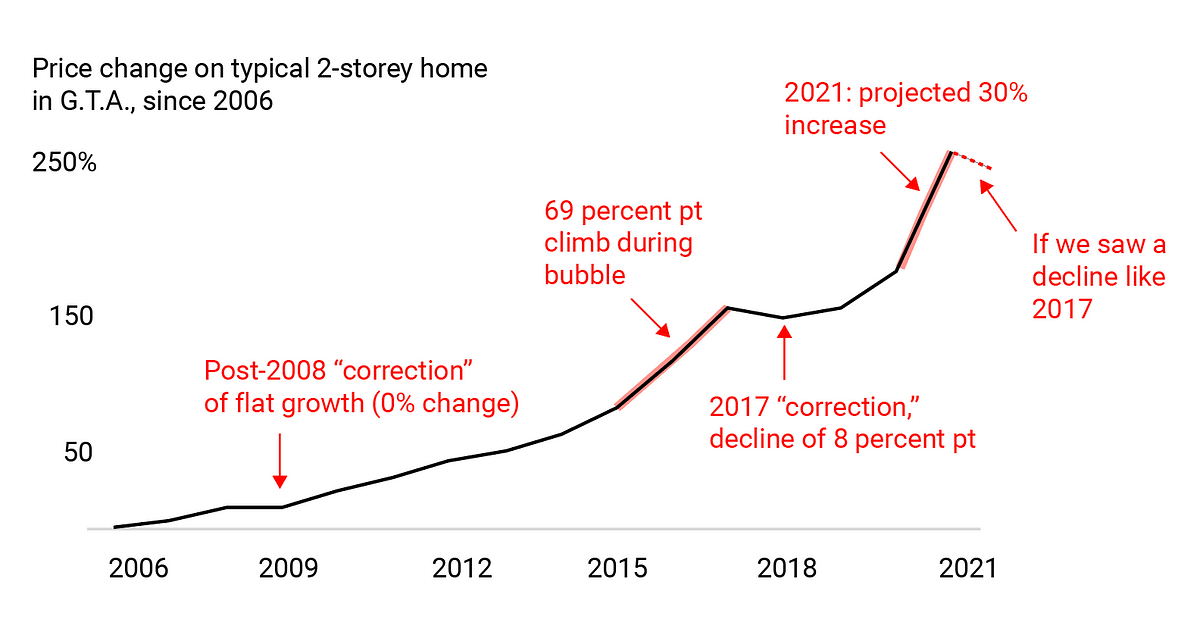

As per the title, I wrote a letter expressing my concerns with the Canadian housing market, and sent it out to over 100 politicians across the country. The addressees were the leaders of every major federal and provincial party, as well as the relevant ministers and opposition critics, and the mayors of every major city in the country.I sent the letter out in early February. Since then, I received only five real responses. The mayors of Montreal and Victoria wrote me back, as did the Green Party housing critic Tim Grant, and David Eby and Wab Kinew of the BC and Manitoba NDP parties respectively. The office of Jagmeet Singh responded with a canned email that discussed policy largely unrelated to the content of my email.I will post each response I received as a separate comment. My original letter follows:To the leaders of this federation,There is significant anxiety regarding the future of this country that is growing in people of my generation, and it is becoming increasingly impossible to ignore.I am an average citizen in my early thirties. I do not represent any special interest group, or hold political affiliation with any party. Due to my line of work, I have lived in multiple provinces, in cities of all sizes, and in rural, urban and suburban areas. I have spent time in almost every province and territory, and I work with, and consider friends, people of all ages and backgrounds from across the country.It is my belief that the biggest reason for this anxiety is the obvious disparity of opportunity growing between the older and younger generations of Canadians. Younger Canadians are increasingly burdened with the reality that no matter how hard they work they will never attain the lifestyle that their parents enjoyed on their own merits alone. This is particularly apparent when you look at the state of Canada’s housing market.Adjusted for inflation, wages have been fairly stagnant over the past couple of decades. At the same time, the cost of living for the average Canadian has increased substantially. According to Statistics Canada, in 2000 the median household income was $58,300, and in 2018 (the last year of available Statistics Canada data) it was $69,600, an increase of 16%. In the same period rent has doubled in many markets and the median price of the average home has increased 257% from $163,951 in 2000 to $586,000 in 2020. The traditional financial advice that housing and related expenses should not exceed thirty percent of gross income is becoming increasingly impossible, particularly in Canada’s urban centres.The drastic increase in Canadian housing prices has put younger Canadians in an untenable situation. Due to the increased cost of living, Canadians are having to put more and more of their income towards shelter. This, coupled with that fact that housing prices are increasing faster than people have the ability to save, is making it near impossible to put together an adequate down payment. The real estate market is no longer tied to the local economy or wages in most markets – Regina has a higher median income than Toronto while having significantly lower housing costs, for example – and so this is unlikely to improve.The excessive increase in prices is putting younger Canadians in a difficult position. Those who are able to pass the stress test and get financing are feeling pressure to purchase simply to get into the market before it becomes impossibly expensive to do so. A six-figure salary isn’t enough in many markets to save for a down payment and purchase a home, and the justified fear is that if they do not purchase now, they will not ever be able to in the future. This is having a massive psychological impact on young Canadians who feel that the future is one where they will never get ahead, even if they do everything right. If traditionally well off workers such as doctors and lawyers are getting left behind in the current market, the average Canadian does not stand a chance. In 2000, the cost of the average home in Canada was 2.8 times the median household income. Today that number is 8.4 times, with it being substantially higher in the GTA and GVA.The COVID-19 pandemic has further exacerbated the situation. Despite historic unemployment, nationwide housing prices increased over 18 percent between August 2019 and August 2020, this is more than the total percentage increase in income over the past twenty years. This is largely due to the Bank of Canada’s decision to cut the key target interest rate to 0.25%, which has reduced mortgage interest rates to historic lows, coupled with the strong performance of the stock market in the same period. Those who were in positions to invest have had great returns, despite the overall dismal performance of the economy. It is more apparent than ever that current economic policies have favoured certain people at the expense of others. Homeowners and those with money to invest have done exceptionally well, while those living pay-cheque to pay-cheque, in the service industry, or just starting their careers, are falling further and further behind.The issues surrounding the Canadian housing market are not new or surprising. Domestically, the Vancouver market was a warning sign of what was to come, as were foreign housing markets in places like Australia and New Zealand. This phenomenon is not unique to Canada. The majority of developed countries have been dealing with similar issues due to the impact that foreign investment, immigration and speculation have had globally.In Canada, and elsewhere, the real estate market has also been used as a place to launder money. Despite the warning signs and the obvious social repercussions of the increased interest in Canadian real estate, governments of all levels have done very little to control the problem. In some ways they have exacerbated it. Housing and real estate now make up over thirteen percent of the GDP, more than any other industry, and seventy six percent of the country’s wealth is wrapped up in real estate. It is too big to fail. In addition, as the riskiest mortgages are insured by the Federal Government through the CMHC, the government has a vested interest in keeping the market from collapsing.So where does that leave young Canadians? Some are lucky enough to have a well-paying job in a market still tied to the local economy (although this is becoming rarer and rarer outside the Prairies). The remainder are forced to pick from an offering of poor options. They can choose to overextend themselves and take on a substantial amount of debt simply so they do not get left behind, or they can rent. Given that all levels of government are unlikely to allow a housing market crash, those who choose to rent will effectively be priced out of the market for good. This means that younger Canadians can either overextend themselves financially, or rent and try to invest what money they have remaining per month elsewhere. It is likely that the majority of Canadians without access to substantial savings or equity will be priced out of the market completely in the next few years. Indeed, in Toronto the average price of a home increased by $119,000 in January 2021 alone.It is evident that the overheated housing market disproportionately harms younger and poorer Canadians. But what of the other demographics? There are real, tangible benefits brought on by the real estate boom. The construction industry is thriving, bringing with it good jobs. Neighbourhoods are being revitalized, and the people who bought into the market at the right time are seeing fabulous growth to their net-worth. In the short term, these all seem like very good things. But in the long term we will pay dearly for it.A high cost of living is bad for the economy. If people are forced to spend more and more of their money just to pay the bills, there is less money for everything else. This affects the ability of small businesses to survive. Indeed, as real estate prices increase, so too do commercial leases. The margins of small businesses become smaller as people have less money to spend and the cost of doing business increases. The independent restaurants, bars and cafes that add vibrancy and desirability to urban centres will find it impossible to stay open. The trend of small businesses giving way to large chains and online services will be completed, and we will all lose out because of it.Many of the condos that are being thrown up to capitalize on the demand are being built poorly with units that are made for investors and not for people to actually live in. These buildings that look shiny and new today have the potential to become the ghettos of the future. High maintenance fees as a result of poor construction will be a further tax on the poor who cannot afford to purchase or rent outside the condo market. High prices will force more and more people into higher density areas, yet political inaction has ensured that no meaningful investment has been made in public transit since the seventies. Rising home prices will increase density, but for various reasons governments have failed to invest in, or regulate, what is necessary to service that density, to spread it out evenly, or to plan with a vision for the future in mind.Another long term consequence – and perhaps the most dire – is that divisions are being created between Canadians. Aside from a generational divide, there is increasing animosity between rural and urban centres as a result of real estate prices. In order to tap into the equity in one’s home, people need to either refinance, downsize, or move to areas with a lower cost of living. Many in a position to leave expensive cities have done so in order to tap into this equity. This has had the negative result of increasing property values in rural areas well above what the local economy can tolerate. There may be an argument that justifies high housing prices in Toronto, Montreal and Vancouver, as they are seen as attractive places on an international level and are deeply tied to the global economy, but the same cannot be said of places like North Bay, Prince George, or Charlottetown. Smaller communities have seen significant price increases that are pushing locals out of the market, and these people have nowhere to go. The prohibitive price of real estate in Vancouver and Toronto has pushed up housing prices in places as far from those cities as Halifax and Moncton – which seem like a bargain in comparison. This is having a negative impact on the people born and raised in those communities. This will cause animosity and division between Canadians, which will inevitably create obstacles to good governance in the future. When groups of people feel alienated, or left behind, there is also a very real potential for political radicalization – and, of particular concern in a federation – increased regionalism.The impact that the housing market is having on the very fabric of Canada cannot be exaggerated. If left unchecked, the consequences of inaction will be catastrophic. The government has lost control, and what little is currently being done has been to the benefit of certain segments of society at the expense of others. So, barring a total collapse of the housing market, what can we do to ensure that the Canada of the future is an equitable one? That this country, with so much potential, stops selling away the chance for its children to enjoy the way of life that older generations took for granted?The solution to the problem is multi-faceted and will require cooperation and a shared vision between multiple layers of government all across the country. This is no small feat in a federation, but this is not something that leaders can continue to dismiss as solely a ‘big city’ or regional problem.There is no doubt that price increases need to be controlled, and the quickest way to accomplish that would be to raise interest rates. The Bank of Canada could do this unilaterally. However, this would punish anyone who recently bought into the market, and it would further put pressure on the economy in the midst of the pandemic. Interest rates will eventually increase, but it is unlikely that this will happen in the short term, as it would be an unpalatable solution to many. That being said, there are other tools available to governments. The end game should be to flatten the market without popping it, while at the same time investing in the future.The first order of business should be to control the influence that organized crime and money laundering have on the market. This dirty money has been seemingly tolerated by politicians and law enforcement for decades and needs to end. There is no excuse for not cracking down on this, and any government that is not in the process of going after these criminals with the full force of their authority is complicit by inaction.Second, the influence that foreign buyers have on the market needs to be curbed. Toronto and Vancouver have already introduced foreign buyer’s taxes and these have had a small, temporary effect on housing prices. Allies like New Zealand and Mexico have already banned or heavily controlled such investment. Although the impact of such measures is currently being debated, it still stands to reason that locals, who wish to actually live in a property, should not be forced to compete on an even playing field with wealthy people from the other side of the world for a roof over their head. This is even more important when it comes to things like agricultural land, which we sell with little restriction to foreigners in many parts of the country. We do not need to be draconian, but we do need to be pragmatic in protecting Canada’s land and housing so that it is first and foremost accessible to all Canadians and permanent residents who actually reside here. We need to remain in control of our own destiny, and should not be forced to pay rent to landlords who live abroad. The regional foreign buyers taxes are a small step towards achieving this end, but the tax is low and there are too many loopholes. Currently many buyers are using proxy corporations to get around these taxes. An immediate step that needs to be taken is to force corporations to disclose who their beneficial owners are. The political resistance to doing this is mind-boggling, and should lead the average Canadian to seriously wonder what motivations are truly driving our lawmakers.Housing speculation and purchasing properties solely for investment purposes needs to be curbed for domestic purchasers as well. With the government’s plans to increase immigration to 401,000 people this year, there is going to be significantly more pressure on Canadian housing. One way to curb this would be through a vacancy tax. It would force people to rent their properties, or face a punitive tax. This money could – and should be – reinvested into building affordable housing. This should be combined with strict controls on Airbnb style rentals, which ate up a significant amount of the housing supply pre-COVID. Airbnbs should not be allowed to operate outside of designated tourist areas, except where the owners occupy the properties themselves. These rules need to be actively enforced, or they will do nothing to solve the problem. We can see clear evidence of this in places like Montréal where Airbnbs still thrive despite regulation.We also need to force developers to build units that are livable and of good quality. Developers have little incentive to build with the future in mind, they want to maximize their profit in the near term. Larger units may be more expensive for investors, but they are better for the average Canadian to actually live in. If the future is one where more people are forced to raise families in apartments and condos, we need to make them suitable for that purpose. Developers should also be forced to have a percentage of their construction go towards purpose-built rentals. Further to this, the influence that developers are having on politicians needs to be investigated, and there needs to be real consequences for cronyism and corruption, particularly on the municipal level.In order to ensure a future where no Canadian gets left behind, governments of all levels, and all across the country, need to plan for the future in an ambitious way. The cultural and political Canadian mentality of only looking a few years ahead needs to stop now. In regards to real estate, this means aggressively forward thinking urban planning, with proper zoning and encouraging certain types of development through regulations and incentives. We need to prevent the construction of future ghettos, unrestrained and environmentally destructive urban sprawl, and gridlock. We need to develop neighbourhoods that are accessible and well-serviced, and not just by cars. With ten percent unemployment, Canada should be looking to invest in major infrastructure projects that provide jobs and fuel the economy while setting us up for the future. Ambitious public transportation projects, affordable housing projects, increasing urban infill and re-zoning areas to medium density are ways of doing this. We should think big with projects such as high speed rail links between our major urban centres.Now is the time to be investing and planning for the future. If we do this, not only will we increase the quality of life for our citizens, but we will make the country a more attractive one to open a business and to set up shop in. We want to encourage talented Canadians to stay and help our country grow, and we want to encourage talented people from around the world to settle here and be a part of making that happen. At the moment, with the high cost of living and no real investment in the future, many talented people will leave or choose to settle elsewhere.We are at a crossroads. If we continue allowing things to go as they are, the future for many Canadians is one where they will see a decreasing quality of life and massively reduced upward mobility. We will see increasing polarization between Canadians that will have implications on the social fabric of this country. However, if we take control today, if we look to the future and start governing for the people as a whole, putting aside short-term election cycle thinking, self-serving policy making, partisanship and regionalism, we can build this country into something great. It isn’t too late, but it is getting close. That is the responsibility of today’s leaders, and so far you are failing us.My questions to you now are: what are you doing to address the concerns that I, and an increasingly high number of my fellow Canadians, have regarding our decreasing prospects for the future? What infrastructure investments are being made, to not only keep up, but to ambitiously move Canada forward? Lastly, how are you looking at modifying current public policy so that it shields younger and less financially secure Canadians from bearing an increasingly unfair share of the costs associated with previous political inaction?I look forward to hearing about your plans for a better, more equitable Canada. via /r/canadahousing https://ift.tt/3cmmpE5